My CRA Business Account Login: Every Canadian Resident will have to open a ‘CRA my account’ as instructed by the Canada Revenue Agency. A similar condition applies to Canadian residents who are in business.

5 My CRA Business Account Programs for Business Purposes:

You can select your desired business program accounts and CRA classifies those business account programs into five types.

They are:

- RT – Goods, and Services Tax/Harmonized Sales Tax,

- RP – Payroll

- RC – Corporate Income Tax

- RM – Import/Export

- RZ – Information Return.

Individual Account Benefits:

A CRA my Account holder (you) can gain benefits in multiple ways and they can be listed as follows:

1. You can make changes, and view or print your ITR statements. In addition, make notice of assessment copies (current/ previous years) and even be able to track tax refunds.

2. You can view or print tax information including T4, T4A (P), T4E, T4 ( OAS), T5, etc. You are eligible to apply and view child benefits like Canada Child Benefit (CCB) and also keep a track of the obtained CCB amount every month.

3. Planning to buy a home? Then, view the Home Buyers’ Plan (HBP) and Lifelong Learning Plan statements. In addition, You will have to verify the Complete deductions as well as of limit and TFSA contribution.

4. You can view emails, notifications, and Climate action incentive payments and can apply for disability tax credit application as well. Moreover, you can view the GST/HST credit payments that are paid out every quarter of the year.

5. You are authorized to update personal info Such as Complete Address, Mobile No, marital status, and banking Details. The POI statements can be opened in PDF format which saves you time and energy.

6. You can feel free to address issues/discrepancies about Employment Insurance payments or its refunds over the CRA my business account. A business account holder can file rebates online for GST/HST.

CRA My Business Features:

The CRA My Business is highly comprehensive and renders features and functionalities that spread across basic settings such as notifications, and managing phone numbers, and enters into the handling of the corporate income tax and the excise duty.

1. Account Management: CRA My Business account management does manage address, phone number, notifications, authorized business numbers of a profile, program account name, modification of the security options, operating names, GST/HST, file a return, view the expected/filed returns, return adjustments, rebate filing, viewing of rebate status, PSB rebate adjustments. In CRA you can file/view elections, view/pay account balance, register a notice of objection in a formal dispute, payroll, file/view return details, show up zero remittance, and respond to notices.

2. PIER Overview: Through the CRA, you can apply to close payroll accounts, view & pay account balances, and remit requirements> You can appeal on a formal dispute by registering @CRA and also make a request on a payment search.

3. Corporate Income Tax: In Corporate Income Tax issues, the CRA services do cover and transmit a return, and you can view return status, return balances, and pay account balance, special elections, and returns (SER). On the CRA module, you can register a notice of objection about a formal dispute in addition, you can view direct deposit transactions, calculate installment payments, enquiries services, and request to close corporation income tax accounts.

4. Other Services Include: The CRA services include air travelers security charge, fuel charge, excise duty, excise tax, the excise tax on insurance premiums, a registered charity, information returns, TFSA, partnerships

5. Contract Payments: In contract payments, you can provide access to your account to an accountant via the ‘Re-present a Client’ portal and by doing so, your account profile settings shall be hidden from the accountant. The particular service is made available to business owners that include partners, directors, officers, employees, or any authorized representatives.

My Cra Account Login at canada.ca.en:

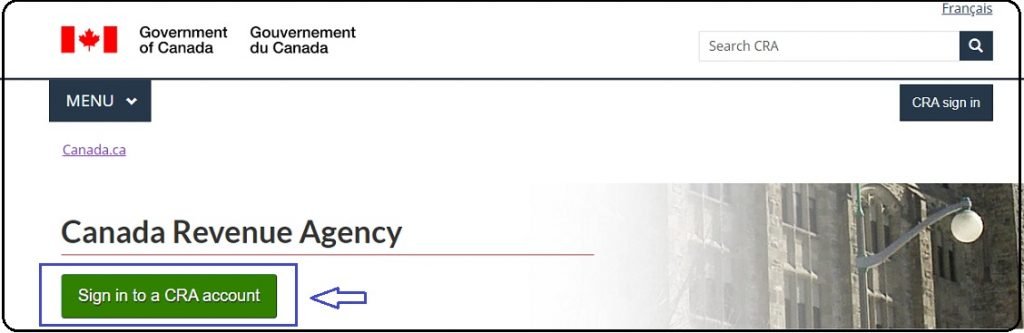

1st Step: The Canadians should meet the official website www.canada.ca/en/revenue-agency.html

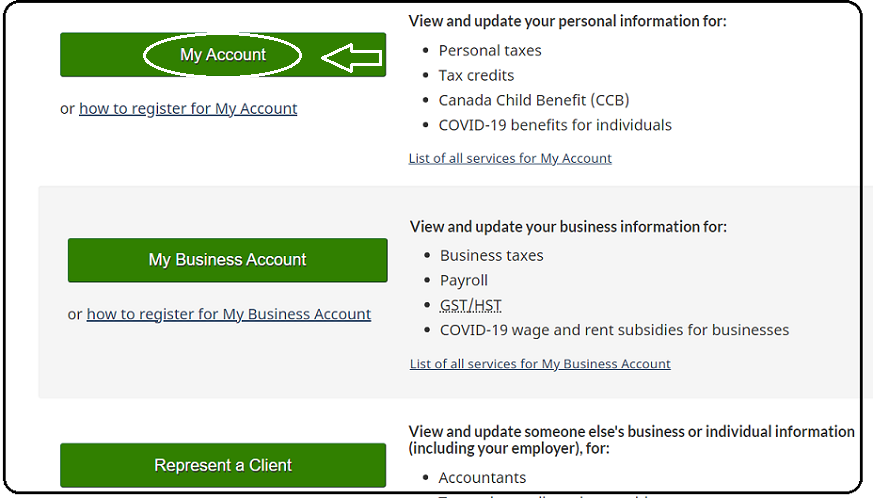

2nd Step: The web portal displays various independent dialogue boxes and you must begin to operate accordingly.

3rd Step: You are advised to hit on the Sign into a CRA account Option on the govt of Canada Home page.

4th Step: After that, the Individuals will have to check the Options on the display like My Account, My Business Account, and Represent a Clint and tap on my Account link.

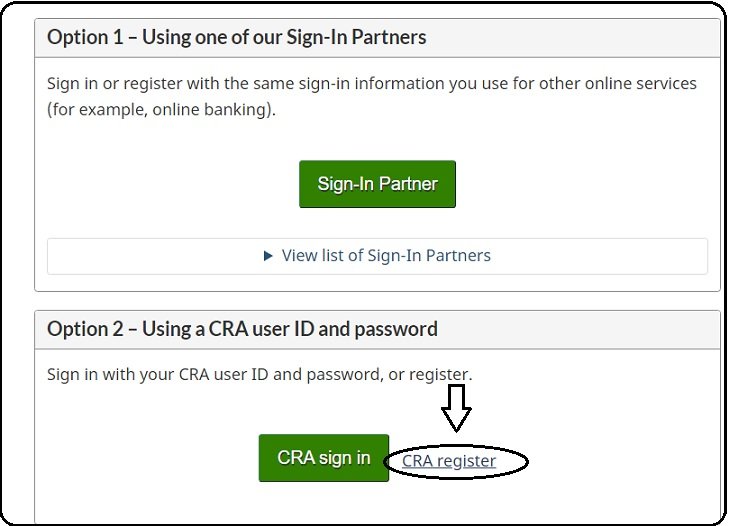

5th Step: You must select to operate option 2 which allows you to utilize the CRA username and password.

6th Step: Therefore, the Individuals should enter their user ID, and password in the blank fields and then click on the login button to enter into their account.

My Cra Account Registration @canada.ca.en

The Canadians should follow the first four steps as mentioned in the Login procedure and then continue the steps as mentioned below.

1. The Individuals should Click the CRA register link on the My account for Individuals page.

2. To validate your identity, the Individual should provide the social insurance number and hit the Next Option.

4. Further, you are expected to validate your identity and hence enter the following fields such as date of birth, postal code, and tax information (previous year returns).

5. For a beginner, you can enter Zero in the tax information field and tap on the next Option.

6. When you enter the next page, create CRA User ID, and Password. Further, you must progress to create security questions and answers on the next page.

7. Once it is complete, your CRA my account gets registered, and thereby the account is created.

Also Read: Wells Fargo CEO ESS Login